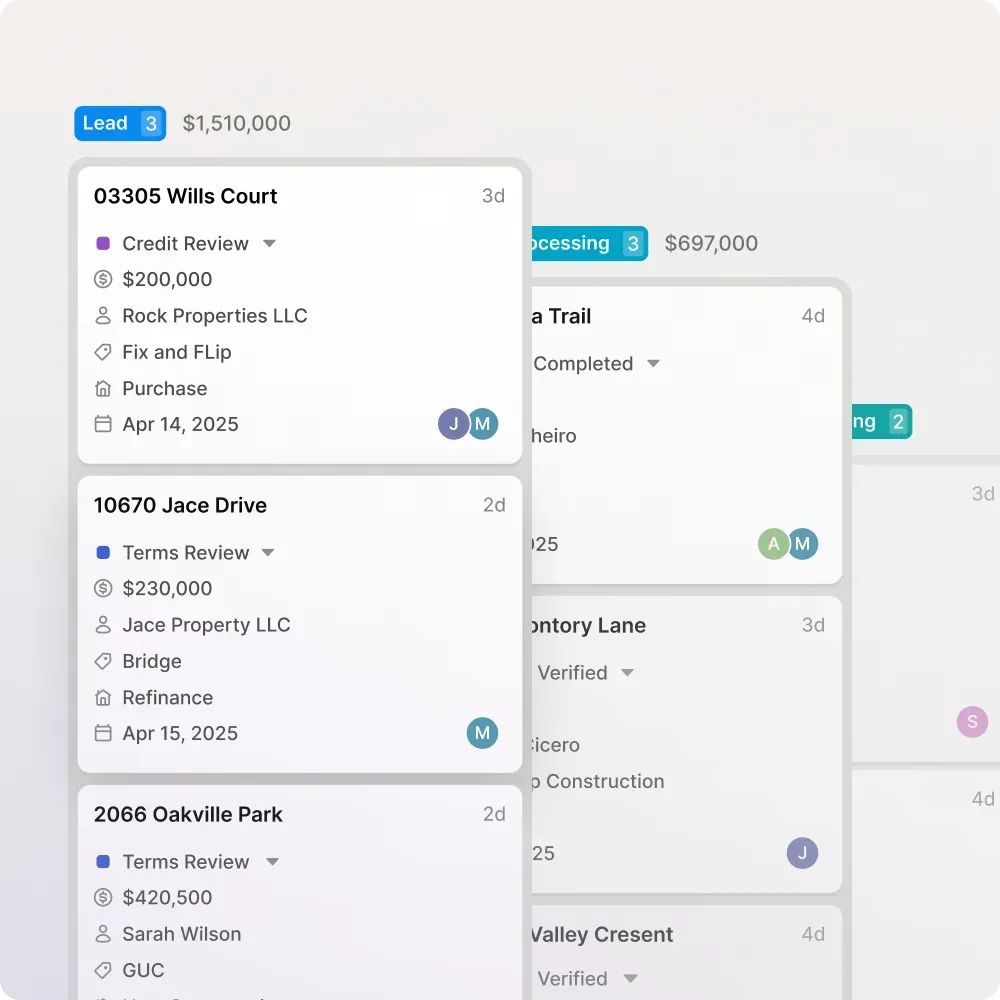

From term sheet to maturity - Baseline has you covered.

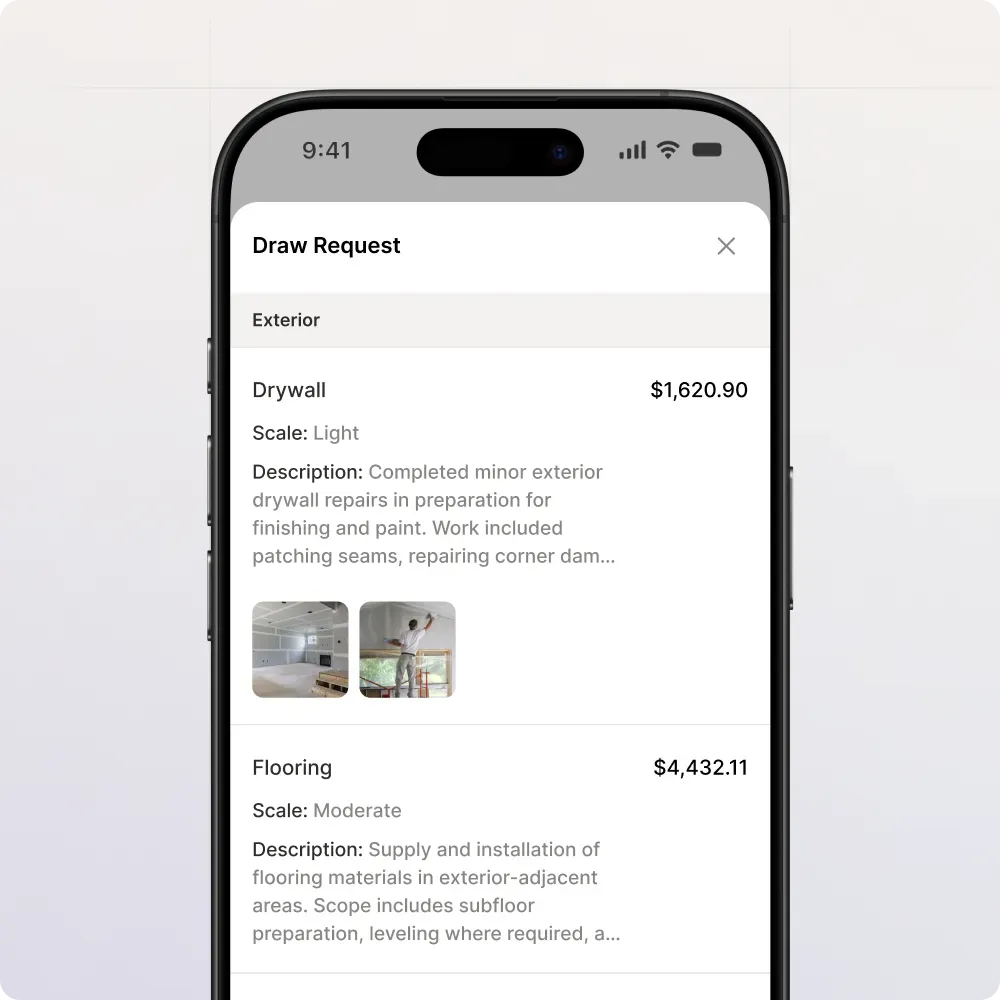

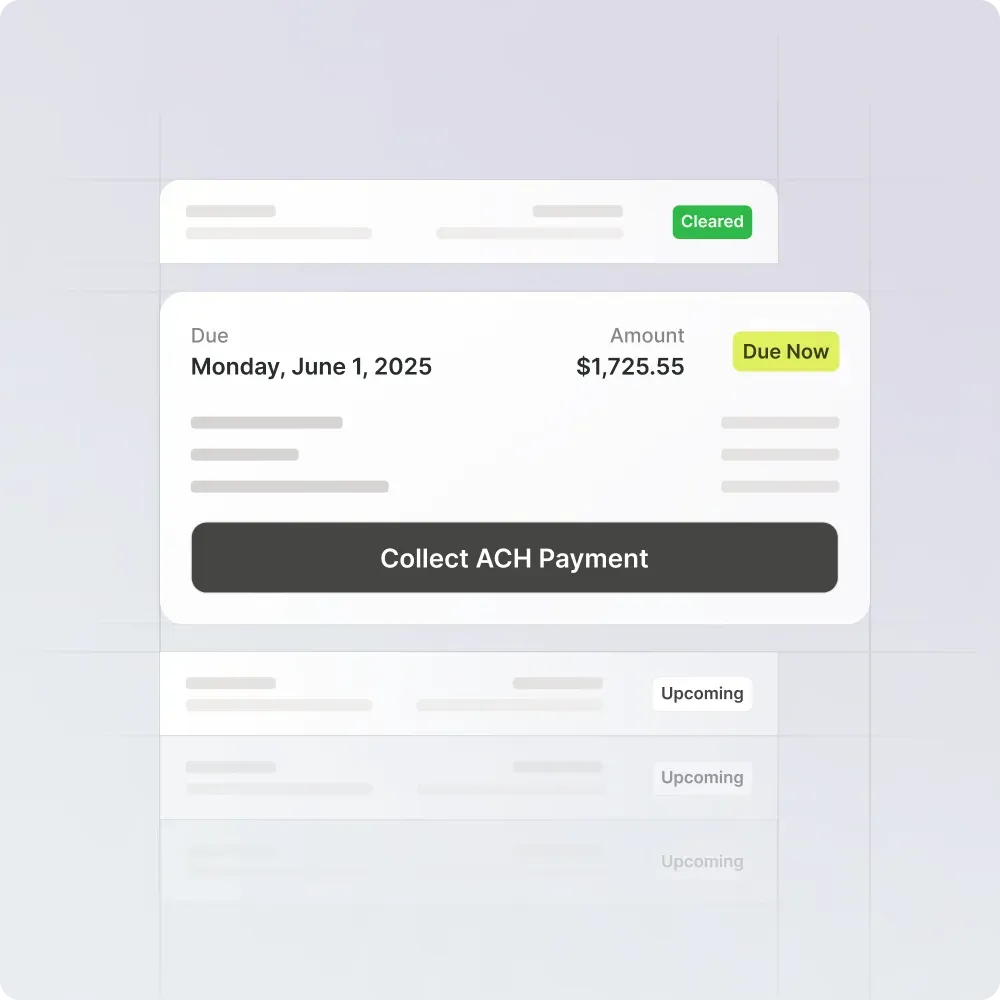

Give borrowers a clear, guided way to apply, upload documents, build budgets, and request draws—without back-and-forth or confusion. Everything flows through one branded portal, keeping borrowers on track while lenders get clean data, faster approvals, and full visibility from scope to fund release.

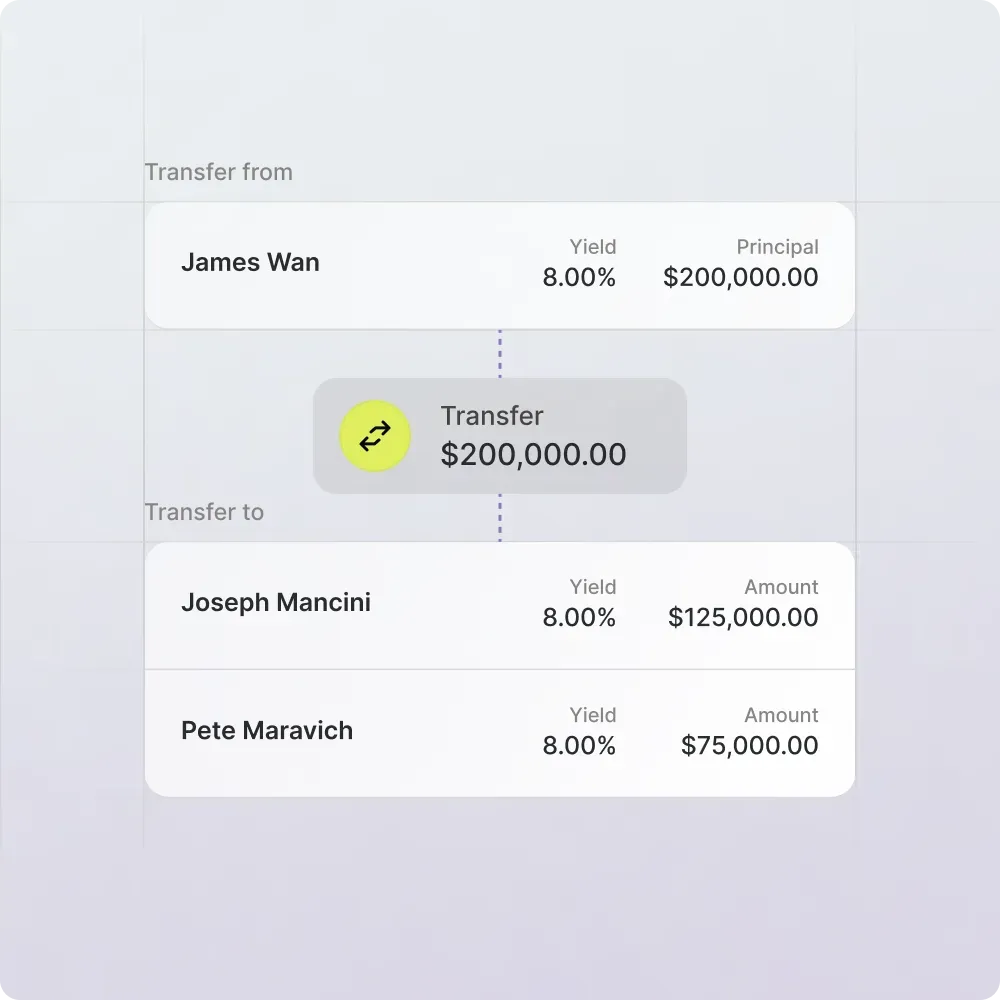

Manage investors, funds, offerings, and distributions in one connected system. Whether you run funds, whole notes, or fractional deals, Baseline gives you precise tracking, automated distributions, clean statements, and a modern investor experience that builds trust.

Baseline is offered on a month-to-month subscription with no long-term commitment required, and you can cancel at any time with 30 days’ notice.